Payment + CRM App

Market Entry Research

Navigating Risks and Opportunities of Global Expansion Strategy through Market Research

An EU-based fintech company is looking to expand its payment and customer relationship management(CRM) product globally.

Our team, based in the US and experienced in building successful business-to-business-to-consumer (B2B2C) products, has been assigned this project.

Challenge

Expand product to new international markets brings risks due to uncertainties surrounding market receptiveness and practical implementation.

Solution

To mitigate risks, we plan to leverage market survey and proof-of-concept studies to better understand the product-market fit of our product. This page focuses on the market entry research.

Methodology

Objective

-

Evaluate potential risks and opportunities associated with the introduction of a CRM solution in the UK

-

Assess the market appetite for elements like messaging, phone numbers, reward structure, and sign-up preferences within the UK market

-

Obtain strategic insight to guide future global expansion of other potential B2B2C products.

Methodology

-

Two survey questionnaires: one designed specifically for merchants and the other for consumers.

-

Sample size: 200 small business merchants and 200 small business consumers based in the UK.

Time Resource Constraints

Challenge

The original plan was to use both qualitative and quantitative research methods. This involved starting with qualitative interviews to gather insights from merchants and consumers, followed by conducting quantitative surveys for validation purposes. However, due to time constraints and reduction in our workforce, I need to adjust the methodology.

Solution

Instead of conducting qualitative interviews, I leverage the desk research and literature reviews from internal and external sources to inform the design of questionnaires.

Questionnaire Design

Merchant and Consumer Perspective

Our main focus is introducing our B2B2C product to merchants, but it’s also important to consider the consumer perspective. Understanding customer viewpoint can greatly influence merchant adoption of our product.

To gather insights from both perspectives, I have developed two separate surveys that approach the same research topic but from different angles.

Based on the research questions derived from stakeholder meetings, I developed about 20 questions for each survey and aim to gather insights on perceptions, experiences with the loyalty program, familiarity with communications, and product concepts.

Questionnaire Types

To ensure comprehensive data collection without overwhelming participants with lengthy surveys and open-ended questions, I utilized a variety of questionnaire formats:

-

Likert scales to gauge feature ratings

-

Multiple-choice questions to asses preferences

-

Open-ended questions to gather narrative perspectives

By combining quantitative and qualitative data obtained from these questionnaires, I was able to explore opportunities for enhancing or redesigning the existing product, gain a deeper understanding of user perspectives, and identify specific areas for improvement.

Language Localization

I collaborated closely with the localization team and conducted pilot surveys on usertesting.com to ensure cultural sensitivity and linguistic accuracy, thereby enhancing the overall readability of the survey.

Respondent Screener

Each survey has specific screeners and segmentation parameters.

- Merchant survey: targets respondents similar to our internal US merchants.

- Consumer survey: targets frequent physical shoppers.

- Segmentation: factors that may influence perceptions of CRM products.

Merchant Screeners

Are you the owner/manager of a small brick-and-mortar business?

(Accept: Yes)

What industry does your business operate in?

(Accept: Retail, Fast Casual Restaurants, Coffee and Tea)

Merchant Segments

Average ticket price

Monthly gross revenue/turnover

Business Location

Number of employees

Years of operation

Consumer Screeners

How often do you visit local small shops/businesses in a typical month?

(Accept) Daily, 2-3 times a week, Once a week, Once every few weeks

(Reject) Once a month, Less than once a month

Consumer Segments

Gender

Location

Age

Click + to view examples of survey questions

Research Question: Are merchants and consumers familiar with loyalty programs? Do merchants express a desire for a rewards and loyalty solution? Are there any competitors in the UK market for loyalty solutions?

Merchant Survey

What loyalty program/platform do you use at your business? Please rank the following statements by priority level for your business. (forced ranking: 1=highest priority, 4= lowest priority)

Which reward and loyalty structure does your business offer?

Consumer Survey

Are you currently part of any reward or loyalty programs at local small businesses?

Research Question: What kind of rewards are merchants currently offering? What kind of rewards do consumers wish to have? What makes consumers uninterested in a loyalty program?

Merchant Survey

Which types of reward and loyalty structure does your business offer? (check all that apply)

Consumer Survey

Which kinds of the following rewards are most appealing to you at local small businesses? (forced ranking: 1=most appealing, 5=least appealing)

What makes you uninterested in the loyalty program at local small businesses? (select up to 3)

Research Question: How do merchants communicate with consumers currently, if at all? What method of communication is best for consumers? At what frequency is acceptable? How do consumers discover merchants?

Merchant Survey

Which of the following communication channels do you mainly use to communicate with your customers? (check all that apply)

Which of the following methods do you use to attract new customers to your business? (check all that apply)

Consumer Survey

How do you typically find a new shop/cafe/coffee shop to visit?

(rows: methods/channels; columns: frequency)

How often, if at all, are you receiving communication from local small businesses?

Analysis

The survey was launched and conducted using SurveyMonkey, generating the targeted 200+ responses from each survey in just four days via SurveyMonkey’s recruitment panel.

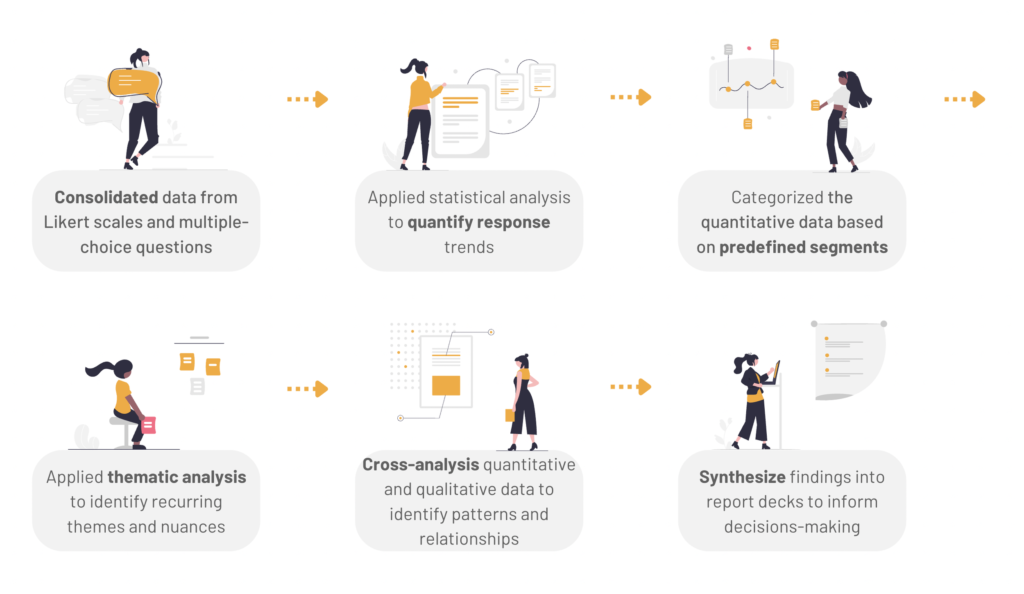

After collecting the data, I utilized SurveyMonkey and Excel for analysis and to create visual representations of the data. The steps are outlined below:

Insight

Our immediate objective through this research is to assess potential risks and opportunities.

- Regarding risk evaluation, the findings have not revealed significant concerns about introducing our B2C2B product to the UK market.

- However, in terms of opportunities, the research suggests that there may be some misalignment between our proposed sign-up method and the dynamics of the UK market.

- Additionally, the research explored various market preferences and offered alternative solutions for future product design. These insights provide valuable guidance for optimizing upcoming iterations of our product.

Impact

Product Imapct

Together with later proof-of-concept research, the research has been valuable in informing market entry strategies and setting the groundwork for future product expansion.

After engaging in extensive communication over several months, the stakeholders were able to secure a commitment of $3 million based on the insights.

Cross-functional Implications

This project, along with later proof-of-concept research, stands out as one of the few internal research that has delved into market entry strategies and preferences across different B2B2C product lines. It continues to be relevant for years and serves as a valuable point of reference for other product teams.

To make sure that the research deliverables are easily accessible and understandable for stakeholders without prior context, I ensured their ready availability. The final report underwent multiple revisions based on feedback and insights from stakeholders.

Reflection

Reflecting on my first international market research experience, I have learned valuable lessons in navigating the complexities of cross-border studies

🌍 Collaboration with International Teams

I took a proactive approach by establishing frequent communication with EU team colleagues, facilitating communication and cultural understanding, thereby expediting overall internal processes.

Acknowledging my limited experience in international research, I sought guidance from senior researchers in the EU team to gain insights into practical strategies for conducting cross-border market research.

👥 Global Participant Recruiting

Recruiting global participants presented its own challenges, as our expertise was primarily focused on US testing participants.

However, by exploring different global recruitment platforms and considering costs and relevance, we were able to select a panel that offered the best balance of affordability and relevance.

⏳ Adopting Time Constraints

I came to appreciate the importance of methodological flexibility.

Due to time constraints, I had to shift our research approach from a mixed-method study to a quantitative survey, ensuring that our research remained on track.

🎯 Setting the Right Expectations

Looking back, I recognize that with a larger budget, a more extensive sample size could have strengthened the survey’s validity. However, given the constraints of using a smaller sample, I learned the importance of transparent communication with stakeholders.

I made sure to clearly outline the survey’s limitations. While the survey results provided valuable guidance, it was crucial to underscore that they offered indications rather than predictions of product success.