Payment + CRM App

Proof-of-concept Research

How a Proof-of-Concept MVP Study Plays a Key Role in Shaping Global Expansion Strategies

An EU-based fintech company is looking to expand its payment and customer relationship management(CRM) product globally.

Our team, based in the US and experienced in building successful business-to-business-to-consumer (B2B2C) products, has been assigned this project.

Challenge

Expand product to new international markets brings risks due to uncertainties surrounding market receptiveness and practical implementation.

Solution

To mitigate risks, we plan to leverage market survey and proof-of-concept studies to better understand the product-market fit of our product. This page focuses on the proof-of-concet research.

Methodology

Objective

- Gathering product feedback through live testing.

- Identifying potential risks and opportunities, pinpointing areas for improvement.

- Offering insights to guide future global expansion efforts for other B2B2C/CRM products.

Methodology

Building on our previous market research, we developed a minimum viable product and planned to launch a proof-of-concept study. This mixed-method study included surveys, ethnography, and user interviews to gather live user feedback and gain further understanding of the market dynamics.

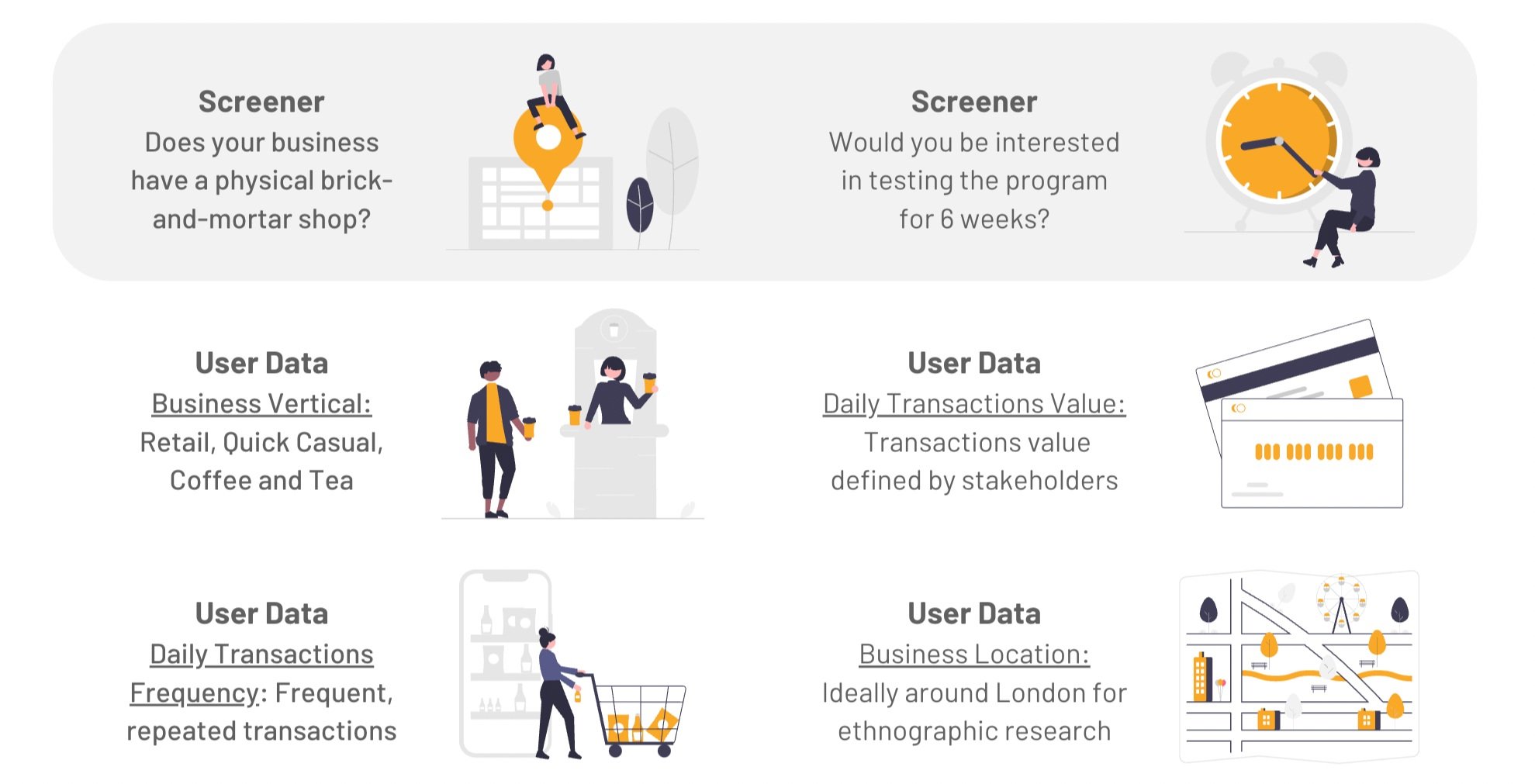

Recruitment

Our goal was to recruit 50 participants. I worked with stakeholders to establish criteria and priorities for identifying the ideal participants. I then leverage survey screeners and internal user data to filter potential participants.

Criteria

- Currently active internal users located in the UK

- Small merchants with physical storefronts

- Have repeat customers

- Interested in a B2B2C/CRM product

- Willing to engage with the testing product for six weeks

We prioritized based on their:

Location

Daily transaction value

Business verticals

For instance, merchants with higher daily transaction values in the quick casual verticals

Weekly Survey

To understand participants’ experiences and prespective with the product, I conducted weekly surveys throughout the 6-week testing period. The survey covered various aspects of the product experience:

UX Metrics: satisfaction, ease of use, and perceived speed

Confusion and difficulties in understanding the content

System bugs and issues

By regularly collecting this data, we were able to track participant perspectives on product performance and onboarding while also addressing any issues or confusion that arose during testing.

Click ➕ to view examples of survey questions

Week 1: Onboarding Experience | 12 Qts | Merchant profile, usability, issues/bug

Sample Questions

Briefly tell us about your business in 1-2 sentences. What are the products and/or services you provide at your business?

How many years has your business been in operation?

What is the total number of full-time and part-time employees at your business?

How easy was it for you to self-onboard? (1=Very difficult, 5=Very easy)

How easy was it for you to understand the points-based reward structure offered? (1=Very difficult, 5=Very easy)

Have you run into any issues? If yes: please describe and let us know what we can do to serve you better.

Week 2-6: Product Feedback | 7 Qts | UX metrics, customer reactions, issues/bugs

Sample Questions

Based on your experience so far, how satisfied are you? (1=Very dissatisfied, 5=Very satisfied)

Based on your experience so far, how would you describe the average speed of signing in customers and redeeming rewards? (1=Very slow, 5=Very fast)

Based on your experience so far, how comfortable did you feel about asking customers for their phone numbers (1=Very uncomfortable, 5=Very comfortable)

Did you happen to feel confused about the program or was there anything that seemed difficult?

Ethnography

The product’s focus on the in-store experience of merchants and consumers makes it crucial to observe their interaction in a natural setting.

We conducted a 7-day ethnographic study across various UK locations, visiting 15 merchants at their storefronts, markets, and home offices.

The ethnographic study allowed us to gain deeper insights into the challenges and opportunities that merchants faced while using the product in their daily operations.

User Interview

I conducted semi-structured user interview to gain a comprehensive understanding of participants’ experiences and needs.

The interviews covered various sections, including introduction, merchant onboarding education, product onboarding process, user flow feedback and usability, customer reactions, and follow-up questions from the diary survey.

Click ➕ to view examples of survey questions

Product Feedback

After two weeks of using the program, what are your thoughts about it? What do you like about the feature so far? Were there any experiences that stood out to you?

Have any issues that happened during this time impacted your business? What can we do to make this experience better?

Customer Reaction

Could you walk me through how you currently introduce the loyalty program to your customers?

Could you walk me through how you currently sign in your customer and redeem points at the end of the transaction?

How have your customers been reacting to the new loyalty program? Do they have any questions? Are their reactions positive/negative? Why?

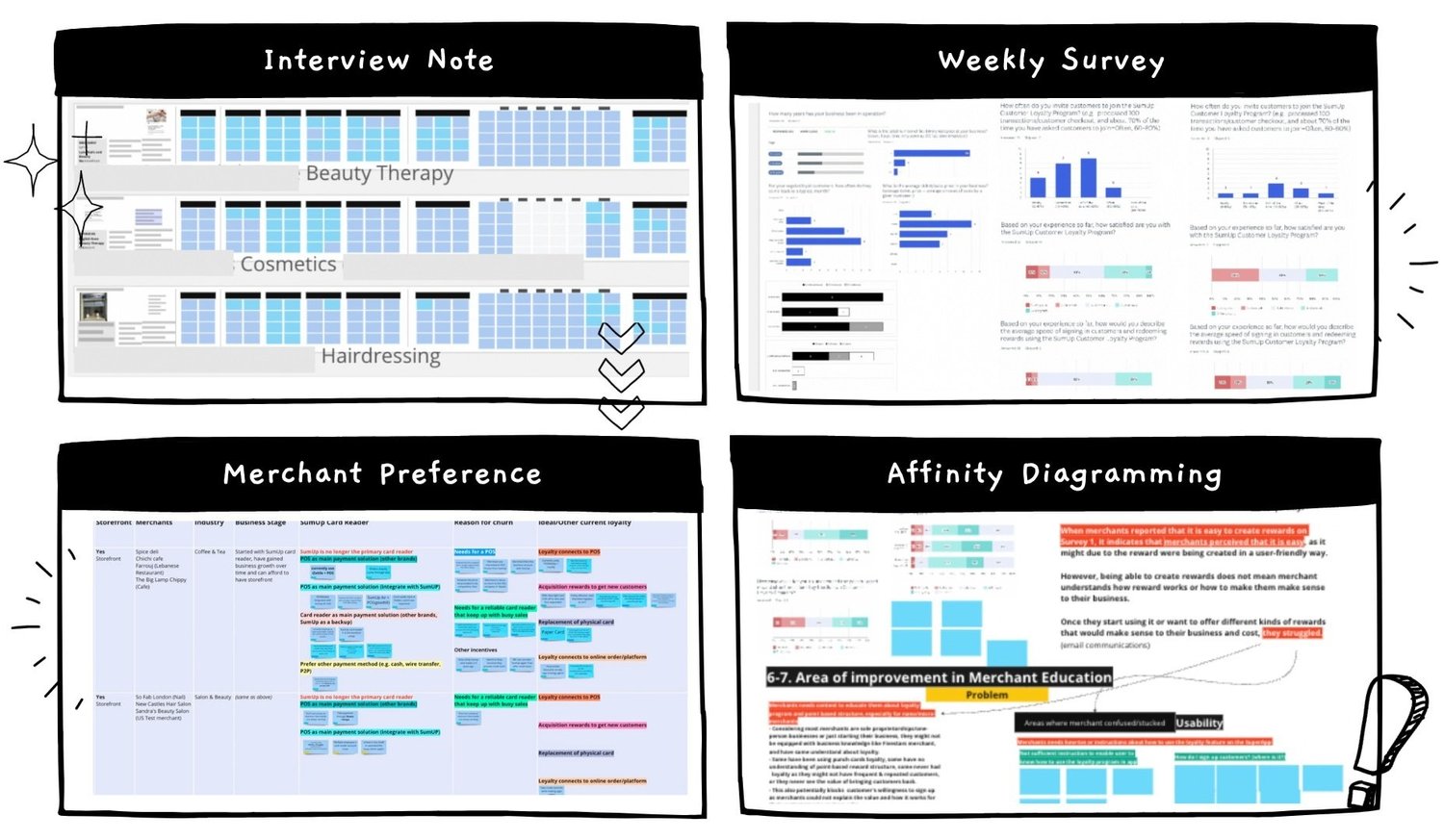

Analysis

After collecting data from survey responses, interview recordings, and ethnographic notes from various sources, I began consolidating these materials to start the analysis.

This collaborative approach promotes transparency and engagement with stakeholders by enabling them to contribute their perspectives and insights during the analysis.

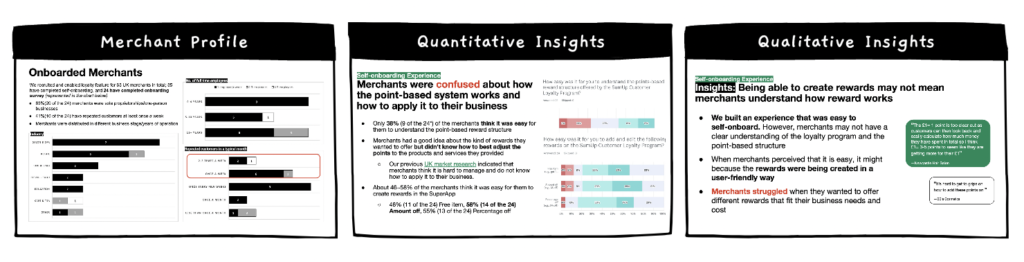

Presentation

I break down the report into multiple sections to effectively convey the findings.

Merchant Profile:

A summarized report from the survey and user data, including details about business sectors, number of employees, recurring customer frequency per month, and other relevant user characteristics that could impact product feedback.

Quantitative Insights:

UX ratings from weekly surveys provide measurable indicators of product performance, including ease of use, perceived speed, and overall satisfaction.

Qualitative Insights:

The interview notes and ethnographic study provided insights into the underlying reasons for the quantitative data, offering valuable suggestions for improving the product’s user experience.

Unexpected Insights

Challenge

In contrast to team’s previous research projects, which focused on usability and user experience, this study aimed to broaden the scope by introducing market entry elements such as cultural suitability and product-market fit. However, these additional considerations were unfamiliar to some design-oriented stakeholders but essential for successful product design and market expansion.

Solution

Effectively communicating these elements is crucial to engaging design-oriented stakeholders who typically expect feedback focused on usability.

My objective is to provide insights that enable stakeholders not only to think about product design but also to consider strategic aspects for our product roadmap.

To achieve this goal, I created communications to help design-oriented stakeholders recognize the gap between our products and target users.

Product or User: I encourage the stakeholders to pause and consider whether we should prioritize building a specific product or concentrate on developing solutions tailored specifically for our target audience.

Refine Direction: After defining this direction, we can then revisit the UX insights gained from this research.

Impact

Product Imapct

Together with market entry research, this research has been valuable in informing market entry strategies and setting the groundwork for future product expansion.

After engaging in extensive communication over several months, the stakeholders were able to secure a commitment of $3 million annually based on the insights.

Cross-functional Implications

This project, along with previous market entry research, stands out as one of the few internal research that has delved into market entry strategies and preferences across different B2B2C product lines. It continues to be relevant for years and serves as a valuable point of reference for other product teams.

To make sure that the research deliverables are easily accessible and understandable for stakeholders without prior context, I ensured their ready availability. The final report underwent multiple revisions based on feedback and insights from stakeholders.

Reflection

Looking back on my first international project experience, it was a dynamic and transformative journey. It pushed me to become more adaptable and creative in finding solutions to unexpected challenges, such as navigating recruitment obstacles, fostering participant engagement, and embracing international ethnography.

Recruitment Challenges

Recruitment Challenges

One major hurdle we faced initially was securing participants who were willing to commit to a six-week research phase.

To overcome this challenge, we implemented multiple strategies:

Sustaining Participant Engagement

Sustaining Participant Engagement

After the product launch, many participants stopped using the product shortly afterward. While this reflected on product performance , it was crucial to gather extensive data.

To address this, I:

International Ethnography

International Ethnography

Our trip to London was both inspiring and challenging. It provided firsthand insights that improved our approach and deepened our understanding.

However, it required:

I successfully navigated these complexities and had meaningful interactions with merchants and participants abroad. Additionally, during our time there, we conducted on-site interviews with internal merchants to maximize efficiency.